Multiple Choice

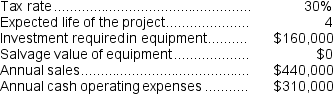

Coffie Corporation has provided the following information concerning a capital budgeting project: The company uses straight-line depreciation on all equipment.

The company uses straight-line depreciation on all equipment.

The total cash flow net of income taxes in year 2 is:

A) $90,000

B) $75,000

C) $130,000

D) $103,000

Correct Answer:

Verified

Correct Answer:

Verified

Q91: Bratton Corporation has provided the following information

Q92: (Appendix 13C) Lafromboise Corporation has provided the

Q93: The following information concerning a proposed capital

Q94: A company anticipates incremental net income (i.e.,incremental

Q95: (Appendix 13C) Boynes Corporation is considering a

Q97: (Appendix 13C) Bourland Corporation is considering a

Q98: (Appendix 13C) Podratz Corporation has provided the

Q99: Mester Corporation has provided the following information

Q100: Lennox Corporation has provided the following information

Q101: (Appendix 13C) Boynes Corporation is considering a