Multiple Choice

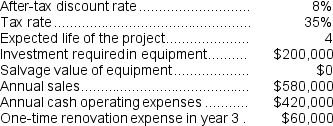

(Appendix 13C) Podratz Corporation has provided the following information concerning a capital budgeting project:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 2 is:

A) $160,000

B) $110,000

C) $121,500

D) $82,500

Correct Answer:

Verified

Correct Answer:

Verified

Q44: Chene Corporation has provided the following information

Q45: (Appendix 13C) Mulford Corporation has provided the

Q46: (Appendix 13C) Mesko Corporation has provided the

Q47: (Appendix 13C) Bourland Corporation is considering a

Q48: (Appendix 13C) Annala Corporation is considering a

Q50: (Appendix 13C) Bourland Corporation is considering a

Q51: (Appendix 13C) Lafromboise Corporation has provided the

Q52: Skowyra Corporation has provided the following information

Q53: Mccrohan Corporation is considering a capital budgeting

Q54: (Appendix 13C) Mesko Corporation has provided the