Multiple Choice

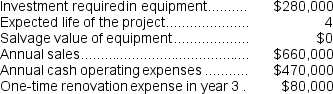

(Appendix 13C) Paletta Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 30% and its after-tax discount rate is 7%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 30% and its after-tax discount rate is 7%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 3 is:

A) $98,000

B) $110,000

C) $74,000

D) $154,000

Correct Answer:

Verified

Correct Answer:

Verified

Q15: (Appendix 13C) Correll Corporation is considering a

Q16: Duma Corporation has provided the following information

Q17: (Appendix 13C) Correll Corporation is considering a

Q18: (Appendix 13C) Paletta Corporation has provided the

Q19: (Appendix 13C) Houze Corporation has provided the

Q21: (Appendix 13C) Reye Corporation has provided the

Q22: (Appendix 13C) Correll Corporation is considering a

Q23: (Appendix 13C) Marbry Corporation has provided the

Q151: When a company invests in equipment, it

Q377: Under the simplifying assumptions made in the