Multiple Choice

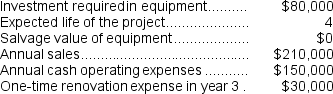

(Appendix 13C) Planas Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 35% and its after-tax discount rate is 14%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 35% and its after-tax discount rate is 14%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

A) $14,000

B) $21,000

C) $3,500

D) $10,500

Correct Answer:

Verified

Correct Answer:

Verified

Q72: Galati Corporation has provided the following information

Q73: (Appendix 13C) Stockinger Corporation has provided

Q74: (Appendix 13C) Prudencio Corporation has provided the

Q76: Marasco Corporation has provided the following information

Q78: (Appendix 13C) Rollans Corporation has provided the

Q79: (Appendix 13C) Bourland Corporation is considering a

Q80: Patenaude Corporation has provided the following information

Q81: (Appendix 13C) Bedolla Corporation is considering a

Q82: Porco Corporation is considering a capital budgeting

Q87: Income taxes have no effect on whether