Essay

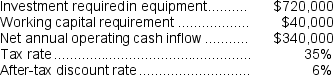

Padmore Corporation has provided the following information concerning a capital budgeting project:

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $240,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $240,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project.Show your work!

Correct Answer:

Verified

Correct Answer:

Verified

Q141: Antinoro Corporation has provided the following information

Q143: (Appendix 13C) Lafromboise Corporation has provided the

Q145: (Appendix 13C) Mulford Corporation has provided the

Q146: (Appendix 13C) Bourland Corporation is considering a

Q147: (Appendix 13C) Vanzant Corporation has provided the

Q149: (Appendix 13C) Vanzant Corporation has provided the

Q150: (Appendix 13C) Correll Corporation is considering a

Q235: Depreciation expense is not included in the

Q379: In net present value analysis, an investment

Q387: The investment in working capital at the