Multiple Choice

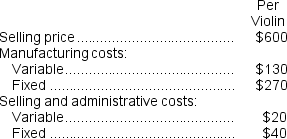

The Bharu Violin Corporation has the capacity to manufacture and sell 5,000 violins each year but is currently only manufacturing and selling 4,800. The following data relate to annual operations at 4,800 units:

Woolgar Symphony Orchestra is interested in purchasing Bharu's excess capacity of 200 units but only if they can get the violins for $350 each. This special order would not affect regular sales or the total fixed costs.

Woolgar Symphony Orchestra is interested in purchasing Bharu's excess capacity of 200 units but only if they can get the violins for $350 each. This special order would not affect regular sales or the total fixed costs.

-If the special order from Woolgar Symphony Orchestra is accepted,the financial advantage (disadvantage) Bharu for the year should be:

A) $40,000

B) ($10,000)

C) ($22,000)

D) ($28,000)

Correct Answer:

Verified

Correct Answer:

Verified

Q67: The constraint at Rauchwerger Corporation is time

Q68: Saalfrank Corporation is considering two alternatives that

Q70: Dock Corporation makes two products from a

Q71: Faustina Chemical Corporation manufactures three chemicals (TX14,NJ35,and

Q71: Cybil Baunt just inherited a 1958 Chevy

Q73: The Melville Corporation produces a single product

Q77: Cranston Corporation makes four products in a

Q230: Accepting a special order will improve overall

Q402: A study has been conducted to determine

Q422: The book value of an old machine