Multiple Choice

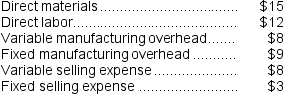

The Melville Corporation produces a single product called a Pong. Melville has the capacity to produce 60,000 Pongs each year. If Melville produces at capacity, the per unit costs to produce and sell one Pong are as follows:

The regular selling price for one Pong is $80. A special order has been received by Melville from Mowen Corporation to purchase 6,000 Pongs next year. If this special order is accepted, the variable selling expense will be reduced by 75%. However, Melville will have to purchase a specialized machine to engrave the Mowen name on each Pong in the special order. This machine will cost $9,000 and it will have no use after the special order is filled. The total fixed manufacturing overhead and selling expenses would be unaffected by this special order. Assume that direct labor is a variable cost.

The regular selling price for one Pong is $80. A special order has been received by Melville from Mowen Corporation to purchase 6,000 Pongs next year. If this special order is accepted, the variable selling expense will be reduced by 75%. However, Melville will have to purchase a specialized machine to engrave the Mowen name on each Pong in the special order. This machine will cost $9,000 and it will have no use after the special order is filled. The total fixed manufacturing overhead and selling expenses would be unaffected by this special order. Assume that direct labor is a variable cost.

-Assume Melville anticipates selling only 50,000 units of Pong to regular customers next year.At what selling price for the 6,000 special order units would Melville be financially indifferent between accepting or rejecting the special order from Mowen?

A) $51.50 per unit

B) $49.00 per unit

C) $37.00 per unit

D) $38.50 per unit

Correct Answer:

Verified

Correct Answer:

Verified

Q151: Marley Corporation makes three products (X,Y,& Z)with

Q152: Swagger Corporation purchases potatoes from farmers.The potatoes

Q153: The Wester Corporation produces three products with

Q154: The management of Woznick Corporation has been

Q157: Kneller Co.manufactures and sells medals for winners

Q159: The Tolar Corporation has 400 obsolete desk

Q160: The SP Corporation makes 40,000 motors to

Q161: Bertucci Corporation makes three products that use

Q204: An avoidable fixed production cost incurred before

Q282: A disadvantage of vertical integration is that