Essay

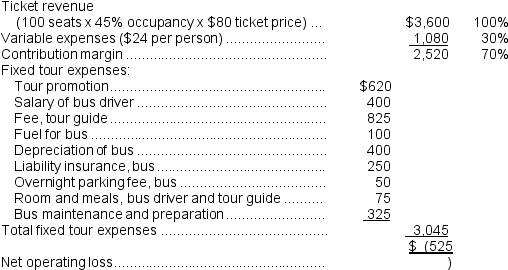

Lakeshore Tours Inc.,operates a large number of tours throughout the United States.A study has indicated that some of the tours are not profitable,and consideration is being given to dropping these tours in order to improve the company's overall operating performance.One such tour is a two-day Battlefields of the French and Indian Wars bus tour.An income statement from one of these tours is given below:

Dropping this tour would not affect the number of buses in the company's fleet or the number of bus drivers on the company's payroll.Buses do not wear out through use; rather,they eventually become obsolete.Bus drivers are paid fixed annual salaries; tour guides are paid for each tour conducted.The "Bus maintenance and preparation" cost above is an allocation of the salaries of mechanics and other service personnel who are responsible for keeping the company's fleet of buses in good operating condition.There would be no change in the number of mechanics and other service personnel as a result of dropping this tour.The liability insurance depends upon the number of buses in the company's fleet and not upon how much they are used.

Dropping this tour would not affect the number of buses in the company's fleet or the number of bus drivers on the company's payroll.Buses do not wear out through use; rather,they eventually become obsolete.Bus drivers are paid fixed annual salaries; tour guides are paid for each tour conducted.The "Bus maintenance and preparation" cost above is an allocation of the salaries of mechanics and other service personnel who are responsible for keeping the company's fleet of buses in good operating condition.There would be no change in the number of mechanics and other service personnel as a result of dropping this tour.The liability insurance depends upon the number of buses in the company's fleet and not upon how much they are used.

Required:

a.Prepare an analysis showing the financial advantage (disadvantage)if this tour is discontinued.

b.The company's tour director has been criticized because only about 50% of the seats on the company's tours are being filled as compared to an average of 60% for the industry.The tour director has explained that the company's average seat occupancy could be improved considerably by eliminating about 10% of the tours,but that doing so would reduce profits.Do you agree with the tour director's conclusion? Explain your response.

Correct Answer:

Verified

b.The elimination of tours with occupan...

b.The elimination of tours with occupan...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q118: Kahn Corporation (a multi-product company) produces and

Q193: Winder Corporation is a specialty component manufacturer

Q194: The management of Bonga Corporation is considering

Q195: Zouar Computer Corporation currently manufactures the disk

Q197: Dock Corporation makes two products from a

Q198: Banfield Corporation makes three products that use

Q202: Consider the following production and cost data

Q203: Vannorman Corporation processes sugar beets in batches.A

Q249: Avoidable costs are irrelevant costs in decisions.

Q408: Sunk costs and future costs that do