Essay

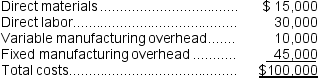

McGraw Company uses 5,000 units of Part X each year as a component in the assembly of one of its products.The company is presently producing Part X internally at a total cost of $100,000,computed as follows:

An outside supplier has offered to provide Part X at a price of $18 per unit.If McGraw Company stops producing the part internally,one-third of the fixed manufacturing overhead would be eliminated.Assume that direct labor is a variable cost.

An outside supplier has offered to provide Part X at a price of $18 per unit.If McGraw Company stops producing the part internally,one-third of the fixed manufacturing overhead would be eliminated.Assume that direct labor is a variable cost.

Required:

Prepare an analysis showing the annual financial advantage or disadvantage of accepting the outside supplier's offer.

Correct Answer:

Verified

* 1/3 × $45,000 = $...

* 1/3 × $45,000 = $...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: Recher Corporation uses part Q89 in one

Q13: The management of Woznick Corporation has been

Q14: Mae Refiners, Inc., processes sugar cane that

Q15: A cost that can be avoided by

Q17: The Melville Corporation produces a single product

Q18: Mcfarlain Corporation is presently making part U98

Q19: Dock Corporation makes two products from a

Q20: Bruce Corporation makes four products in a

Q226: An avoidable cost is a sunk cost

Q401: Wallen Corporation is considering eliminating a department