Essay

Prosner Corp.manufactures three products from a common input in a joint processing operation.Joint processing costs up to the split-off point total $500,000 per year.The company allocates these costs to the joint products on the basis of their total sales value at the split-off point.

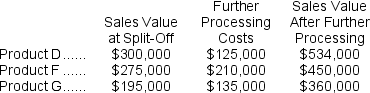

Each product may be sold at the split-off point or processed further.The additional processing costs and sales value after further processing for each product (on an annual basis)are:

Required:

Required:

Which product or products should be sold at the split-off point,and which product or products should be processed further? Show computations.

Correct Answer:

Verified

Products D and G should be so...

Products D and G should be so...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q51: Boney Corporation processes sugar beets that it

Q52: Gottshall Inc.makes a range of products.The company's

Q53: Sardi Inc.is considering whether to continue to

Q54: The constraint at Pickrel Corporation is time

Q55: The Draper Corporation is considering dropping its

Q57: Marsdon Company has an annual production capacity

Q58: The Tolar Corporation has 400 obsolete desk

Q59: Kirsten Corporation makes 100,000 units per year

Q60: The management of Schmader Corporation is considering

Q61: Ouzts Corporation is considering Alternative A and