Essay

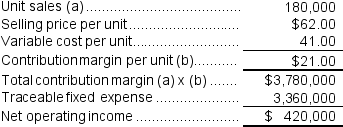

Ohanlon Corporation manufactures numerous products,one of which is called Delta27.The company has provided the following data about this product:

Required:

Required:

a.Management is considering increasing the price of Delta27 by 5%,from $62.00 to $65.10.The company's marketing managers estimate that this price hike would decrease unit sales by 10%,from 180,000 units to 162,000 units.Assuming that the total traceable fixed expense does not change,what net operating income will Delta27 earn at a price of $65.10 if this sales forecast is correct?

b.Assuming that the total traceable fixed expense does not change,if Ohanlon increases the price of Delta27 to $65.10,what percentage change in unit sales would provide the same net operating income that it currently earns at a price of $62.00? (Round your answer to the nearest one-tenth of a percent.)

Correct Answer:

Verified

a.The profit at the price of $65.10 per ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q47: A new product, an automated crepe maker,

Q69: Chruch Corporation manufactures numerous products, one of

Q72: Hill Corporation is contemplating the introduction of

Q73: Morice Industries Inc. has developed a new

Q75: Seamons Corporation has the following information available

Q76: Magney,Inc.,uses the absorption costing approach to cost-plus

Q120: Bohmker Corporation is introducing a new product

Q305: Bellini Robotics Corporation has developed a new

Q309: The markup over cost under the absorption

Q337: Holding all other things constant, if the