Essay

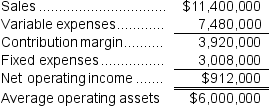

Ranallo Inc.reported the following results from last year's operations:

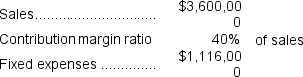

At the beginning of this year,the company has a $1,800,000 investment opportunity with the following characteristics:

At the beginning of this year,the company has a $1,800,000 investment opportunity with the following characteristics:

The company's minimum required rate of return is 14%.

The company's minimum required rate of return is 14%.

Required:

1.What was last year's margin? (Round to the nearest 0.1%.)

2.What was last year's turnover? (Round to the nearest 0.01.)

3.What was last year's return on investment (ROI)? (Round to the nearest 0.1%.)

4.What is the margin related to this year's investment opportunity? (Round to the nearest 0.1%.)

5.What is the turnover related to this year's investment opportunity? (Round to the nearest 0.01.)

6.What is the ROI related to this year's investment opportunity? (Round to the nearest 0.1%.)

7.If the company pursues the investment opportunity and otherwise performs the same as last year,what will be the overall margin this year? (Round to the nearest 0.1%.)

8.If the company pursues the investment opportunity and otherwise performs the same as last year,what will be the overall turnover this year? (Round to the nearest 0.01.)

9.If the company pursues the investment opportunity and otherwise performs the same as last year,what will be the overall ROI will this year? (Round to the nearest 0.1%.)

10.If Westerville's chief executive officer earns a bonus only if the ROI for this year exceeds the ROI for last year,would the CEO pursue the investment opportunity? Would the owners of the company want the CEO to pursue the investment opportunity?

11.What was last year's residual income?

12.What is the residual income of this year's investment opportunity?

13.If the company pursues the investment opportunity and otherwise performs the same as last year,what will be the overall residual income this year?

14.If Westerville's CEO earns a bonus only if residual income for this year exceeds residual income for last year,would the CEO pursue the investment opportunity?

Correct Answer:

Verified

1.Last year's Margin = Net operating inc...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q157: Kingcade Corporation keeps careful track of the

Q158: Santoyo Corporation keeps careful track of the

Q160: Schlarbaum Corporation's management keeps track of the

Q161: The following data are for the Akron

Q163: Shrewsbury Inc. reported the following results from

Q164: Rotan Corporation keeps careful track of the

Q165: The following data pertain to Turk Company's

Q166: Which of the following will increase a

Q167: Selma Inc.reported the following results from last

Q199: All other things the same, an increase