Multiple Choice

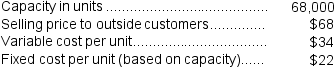

Mittan Products,Inc.,has a Antennae Division that manufactures and sells a number of products,including a standard antennae that could be used by another division in the company,the Aircraft Products Division,in one of its products.Data concerning that antennae appear below: The Aircraft Products Division is currently purchasing 4,000 of these antennaes per year from an overseas supplier at a cost of $66 per antennae.

The Aircraft Products Division is currently purchasing 4,000 of these antennaes per year from an overseas supplier at a cost of $66 per antennae.

Assume that the Valve Division is selling all of the valves it can produce to outside customers.From the standpoint of the Valve Division,what is the lost contribution margin if the valves are transferred internally rather than sold to outside customers?

A) $48,000

B) $136,000

C) $2,312,000

D) $152,000

Correct Answer:

Verified

Correct Answer:

Verified

Q37: If transfer prices are to be based

Q59: (Appendix 11A) Royal Products, Inc., has a

Q60: Cominsky Products,Inc.,has a Screen Division that manufactures

Q62: Siegrist Products,Inc.,has a Pump Division that manufactures

Q63: Chesley Products,Inc.,has a Connector Division that manufactures

Q65: (Appendix 11A) Two of the decentralized divisions

Q66: (Appendix 11A) Oberley Products, Inc., has a

Q67: (Appendix 11A) Fregozo Products, Inc., has a

Q68: (Appendix 11A) Germano Products, Inc., has a

Q237: Division E of Harveq Company has the