Multiple Choice

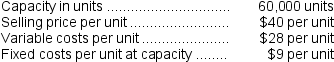

(Appendix 11A) Division A of Tripper Company produces a part that it sells to other companies. Sales and cost data for the part follow:

Division B, another division of Tripper Company, would like to buy this part from Division A. Division B is presently purchasing the part from an outside source at $38 per unit. If Division A sells to Division B, $1 in variable costs can be avoided.

Division B, another division of Tripper Company, would like to buy this part from Division A. Division B is presently purchasing the part from an outside source at $38 per unit. If Division A sells to Division B, $1 in variable costs can be avoided.

-Assume that Division A is presently operating at capacity.According to the formula in the text,what is the lowest acceptable transfer price from the viewpoint of the selling division?

A) $37 per unit

B) $39 per unit

C) $36 per unit

D) $38 per unit

Correct Answer:

Verified

Correct Answer:

Verified

Q51: (Appendix 11A) Bacot Products, Inc., has a

Q52: Wamsley Products,Inc.,has a Transmitter Division that manufactures

Q53: Ricardo Products,Inc.,has a Motor Division that manufactures

Q54: (Appendix 11A) Ganus Products, Inc., has a

Q55: (Appendix 11A) Yearout Products, Inc., has a

Q57: (Appendix 11A) Brull Products, Inc., has a

Q58: Division G makes a part that it

Q59: (Appendix 11A) Royal Products, Inc., has a

Q60: Cominsky Products,Inc.,has a Screen Division that manufactures

Q237: Division E of Harveq Company has the