Multiple Choice

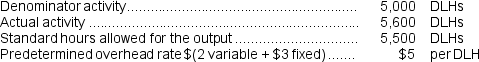

Harris Corporation uses a standard cost system in which it applies manufacturing overhead to units of product on the basis of standard direct labor-hours (DLHs) .The company has provided the following data: The volume variance would be:

The volume variance would be:

A) $2,500 F

B) $1,800 F

C) $1,800 U

D) $1,500 F

Correct Answer:

Verified

Correct Answer:

Verified

Q37: (Appendix 10A) Vaden Incorporated makes a single

Q38: Emanuele Incorporated makes a single product--a critical

Q39: (Appendix 10A) Jessep Corporation has a standard

Q40: Edlow Incorporated makes a single product--a critical

Q41: (Appendix 10A) Wineman Incorporated makes a single

Q43: Likes Incorporated makes a single product--a cooling

Q45: (Appendix 10A) Chojnowski Incorporated makes a single

Q46: Mclellan Corporation applies manufacturing overhead to products

Q47: A company has a standard cost system

Q310: Moozi Dairy Products processes and sells two