Multiple Choice

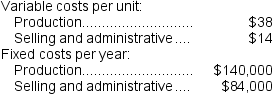

The Southern Corporation manufactures a single product and has the following cost structure:

Last year, 7,000 units were produced and 6,800 units were sold. There was no beginning inventory.

Last year, 7,000 units were produced and 6,800 units were sold. There was no beginning inventory.

-Under variable costing,the unit product cost would be:

A) $38 per unit

B) $52 per unit

C) $58 per unit

D) $70 per unit

Correct Answer:

Verified

Correct Answer:

Verified

Q21: When sales exceed production and the company

Q44: Absorption costing treats all manufacturing costs as

Q52: McCoy Corporation manufactures a computer monitor. Shown

Q54: Farris Corporation, which has only one product,

Q55: Koff Corporation has two divisions:<br> Garden Division

Q58: Bellue Inc.manufactures a single product.Variable costing net

Q62: Caruso Inc., which produces a single product,

Q97: Absorption costing treats all fixed costs as

Q227: J Corporation has two divisions. Division A

Q235: All other things the same, if a