Multiple Choice

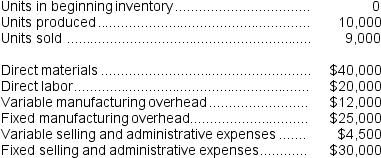

Kern Corporation produces a single product. Selected information concerning the operations of the company follow:

Assume that direct labor is a variable cost.

Assume that direct labor is a variable cost.

-Which costing method,absorption or variable costing,would show a higher operating income for the year and by what amount?

A) Absorption costing net operating income would be higher than variable costing net operating income by $2,500.

B) Variable costing net operating income would be higher than absorption costing net operating income by $2,500.

C) Absorption costing net operating income would be higher than variable costing net operating income by $5,500.

D) Variable costing net operating income would be higher than absorption costing net operating income by $5,500.

Correct Answer:

Verified

Correct Answer:

Verified

Q116: Assuming that direct labor is a variable

Q127: The following data pertain to last year's

Q128: Baraban Corporation has provided the following data

Q129: Kaaua Corporation has provided the following data

Q130: Hadley Corporation, which has only one product,

Q134: The Southern Corporation manufactures a single product

Q136: Higado Confectionery Corporation has a number of

Q136: Neelon Corporation has two divisions: Southern Division

Q263: The salary paid to a store manager

Q289: If a cost must be arbitrarily allocated