Multiple Choice

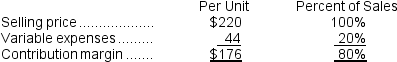

Thornbrough Corporation produces and sells a single product with the following characteristics:

The company is currently selling 7,000 units per month. Fixed expenses are $901,000 per month. Consider each of the following questions independently.

The company is currently selling 7,000 units per month. Fixed expenses are $901,000 per month. Consider each of the following questions independently.

-This question is to be considered independently of all other questions relating to Thornbrough Corporation.Refer to the original data when answering this question. Management is considering using a new component that would increase the unit variable cost by $11.Since the new component would increase the features of the company's product,the marketing manager predicts that monthly sales would increase by 500 units.What should be the overall effect on the company's monthly net operating income of this change?

A) increase of $82,500

B) decrease of $5,500

C) decrease of $82,500

D) increase of $5,500

Correct Answer:

Verified

Correct Answer:

Verified

Q35: Mason Corporation's selling price was $20 per

Q213: Corporation X sold 25,000 units of product

Q221: Iverson Corporation's variable expenses are 60% of

Q230: Majid Corporation sells a product for $240

Q238: Duve Corporation has provided the following contribution

Q240: Rachal Corporation produces and sells a single

Q242: Zanetti Corporation produces and sells a single

Q246: Lofft Corporation has provided the following contribution

Q247: Huitron Inc.expects its sales in September to

Q248: Goodman Corporation has sales of 3,000 units