Multiple Choice

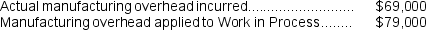

Faughn Corporation has provided the following data concerning manufacturing overhead for July: The company's Cost of Goods Sold was $243,000 prior to closing out its Manufacturing Overhead account.The company closes out its Manufacturing Overhead account to Cost of Goods Sold.Which of the following statements is true?

The company's Cost of Goods Sold was $243,000 prior to closing out its Manufacturing Overhead account.The company closes out its Manufacturing Overhead account to Cost of Goods Sold.Which of the following statements is true?

A) Manufacturing overhead was underapplied by $10,000; Cost of Goods Sold after closing out the Manufacturing Overhead account is $233,000

B) Manufacturing overhead was overapplied by $10,000; Cost of Goods Sold after closing out the Manufacturing Overhead account is $233,000

C) Manufacturing overhead was overapplied by $10,000; Cost of Goods Sold after closing out the Manufacturing Overhead account is $253,000

D) Manufacturing overhead was underapplied by $10,000; Cost of Goods Sold after closing out the Manufacturing Overhead account is $253,000

Correct Answer:

Verified

Correct Answer:

Verified

Q27: Chipata Corporation applies manufacturing overhead to jobs

Q194: Dagostino Corporation uses a job-order costing system.

Q195: Weatherhead Inc.has provided the following data for

Q196: Dagostino Corporation uses a job-order costing system.

Q198: Acheson Corporation, which applies manufacturing overhead on

Q201: Fisher Corporation uses a predetermined overhead rate

Q202: Leelanau Corporation uses a job-order costing system.The

Q203: Niles Corporation is a manufacturer that uses

Q204: Vogel Corporation's cost of goods manufactured last

Q220: On a manufacturing company's income statement, direct