Multiple Choice

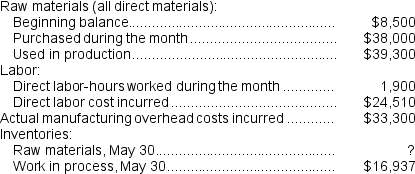

Dacosta Corporation had only one job in process on May 1. The job had been charged with $1,800 of direct materials, $6,966 of direct labor, and $9,936 of manufacturing overhead cost. The company assigns overhead cost to jobs using the predetermined overhead rate of $18.40 per direct labor-hour.

During May, the following activity was recorded:

Work in process inventory on May 30 contains $3,741 of direct labor cost. Raw materials consist solely of items that are classified as direct materials.

Work in process inventory on May 30 contains $3,741 of direct labor cost. Raw materials consist solely of items that are classified as direct materials.

-The entry to dispose of the underapplied or overapplied manufacturing overhead cost for the month would include a:

A) credit of $5,336 to Manufacturing Overhead.

B) credit of $1,660 to Manufacturing Overhead.

C) debit of $5,336 to Manufacturing Overhead.

D) debit of $1,660 to Manufacturing Overhead.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Echher Corporation uses a job-order costing system

Q4: Vogel Corporation's cost of goods manufactured last

Q5: Entry (11)in the below T-account could represent

Q6: Gurtner Corporation has provided the following data

Q9: The following partially completed T-accounts are for

Q10: On November 1, Arvelo Corporation had $32,000

Q11: Refer to the T-account below:<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2580/.jpg" alt="Refer

Q12: Dukes Corporation used a predetermined overhead rate

Q13: Tevebaugh Corporation is a manufacturer that uses

Q230: In the Schedule of Cost of Goods