Multiple Choice

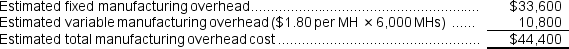

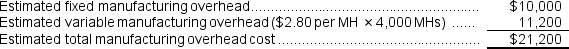

Fee The first step is to calculate the estimated total overhead costs in the two departments.

Machining

Customizing

Customizing

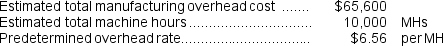

The second step is to combine the estimated manufacturing overhead costs in the two departments ($44,400 + $21,200 = $65,600) to calculate the plantwide predetermined overhead rate as follow:

The second step is to combine the estimated manufacturing overhead costs in the two departments ($44,400 + $21,200 = $65,600) to calculate the plantwide predetermined overhead rate as follow:

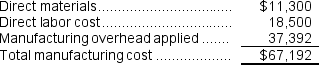

The overhead applied to Job C is calculated as follows:

The overhead applied to Job C is calculated as follows:

Overhead applied to a particular job = Predetermined overhead rate x Machine-hours incurred by the job

= $6.56 per MH x (4,100 MHs + 1,600 MHs)

= $6.56 per MH x (5,700 MHs)

= $37,392

Job C's manufacturing cost:

Reference: CH02-Ref24

Reference: CH02-Ref24

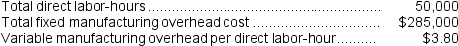

Prather Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on the following data:

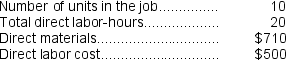

Recently, Job P513 was completed with the following characteristics:

Recently, Job P513 was completed with the following characteristics:

-The estimated total manufacturing overhead is closest to:

A) $475,000

B) $285,000

C) $190,000

D) $285,004

Correct Answer:

Verified

Correct Answer:

Verified

Q136: In a job-order costing system that is

Q137: Almaraz Corporation has two manufacturing departments--Forming and

Q138: Stoke Corporation has two production departments, Forming

Q139: Giannitti Corporation bases its predetermined overhead rate

Q140: Cardosa Corporation uses a job-order costing system

Q142: Bolander Corporation uses a job-order costing system

Q143: Kubes Corporation uses a job-order costing system

Q144: Merati Corporation has two manufacturing departments--Forming and

Q145: Which of the following would usually be

Q146: Harootunian Corporation uses a job-order costing system