Multiple Choice

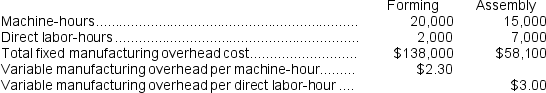

Stoke Corporation has two production departments, Forming and Assembly. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Forming Department's predetermined overhead rate is based on machine-hours and the Assembly Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:

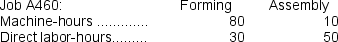

During the current month the company started and finished Job A460. The following data were recorded for this job:

During the current month the company started and finished Job A460. The following data were recorded for this job:

-The amount of overhead applied in the Assembly Department to Job A460 is closest to:

A) $415.00

B) $150.00

C) $565.00

D) $79,100.00

Correct Answer:

Verified

Correct Answer:

Verified

Q82: Moscone Corporation bases its predetermined overhead rate

Q173: Marioni Corporation has two manufacturing departments--Forming and

Q174: Gerstein Corporation uses a job-order costing system

Q175: Juanita Corporation uses a job-order costing system

Q176: Atteberry Corporation has two manufacturing departments--Machining and

Q177: Johansen Corporation uses a predetermined overhead rate

Q180: Branin Corporation uses a job-order costing system

Q181: Leeds Corporation uses a job-order costing system

Q182: Claybrooks Corporation has two manufacturing departments--Casting and

Q183: Kroeker Corporation has two production departments, Milling