Essay

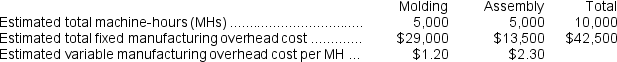

Harnett Corporation has two manufacturing departments--Molding and Assembly.The company used the following data at the beginning of the period to calculate predetermined overhead rates:

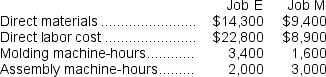

During the period,the company started and completed two jobs--Job E and Job M.Data concerning those two jobs follow:

During the period,the company started and completed two jobs--Job E and Job M.Data concerning those two jobs follow:

Required:

Required:

a.Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours.Calculate that overhead rate.

b.Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours.Calculate the amount of manufacturing overhead applied to Job E.

c.Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours.Calculate the total manufacturing cost assigned to Job E.

d.Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours and uses a markup of 60% on manufacturing cost to establish selling prices.Calculate the selling price for Job E.

e.Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments.What is the departmental predetermined overhead rate in the Molding department?

f.Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments.What is the departmental predetermined overhead rate in the Assembly department?

g.Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments.How much manufacturing overhead will be applied to Job E?

h.Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments.Further assume that the company uses a markup of 60% on manufacturing cost to establish selling prices.Calculate the selling price for Job E.

Correct Answer:

Verified

a.The first step is to calculate the est...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: Quiet Corporation uses a job-order costing system

Q86: In a job-order cost system, indirect labor

Q98: Bulla Corporation has two production departments,Machining and

Q100: Gerstein Corporation uses a job-order costing system

Q101: Harootunian Corporation uses a job-order costing system

Q102: Fee The first step is to calculate

Q104: Eisentrout Corporation has two production departments, Machining

Q105: Beans Corporation uses a job-order costing system

Q108: Levron Corporation uses a job-order costing system

Q250: Fillmore Corporation uses a job-order costing system