Essay

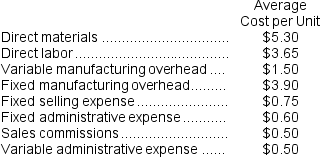

Saxbury Corporation's relevant range of activity is 3,000 units to 7,000 units.When it produces and sells 5,000 units,its average costs per unit are as follows:

Required:

Required:

a.For financial reporting purposes,what is the total amount of product costs incurred to make 5,000 units?

b.For financial reporting purposes,what is the total amount of period costs incurred to sell 5,000 units?

c.If 6,000 units are sold,what is the variable cost per unit sold?

d.If 6,000 units are sold,what is the total amount of variable costs related to the units sold?

e.If 6,000 units are produced,what is the average fixed manufacturing cost per unit produced?

f.If 6,000 units are produced,what is the total amount of fixed manufacturing cost incurred?

g.If 6,000 units are produced,what is the total amount of manufacturing overhead cost incurred? What is this total amount expressed on a per unit basis?

h.If the selling price is $22.90 per unit,what is the contribution margin per unit sold?

i.If 4,000 units are produced,what is the total amount of direct manufacturing cost incurred?

j.If 4,000 units are produced,what is the total amount of indirect manufacturing cost incurred?

k.What incremental manufacturing cost will the company incur if it increases production from 5,000 to 5,001 units?

Correct Answer:

Verified

a.

b.

b.

c.

c.

d.

d.

e.

e.

*The average fi...

*The average fi...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: A cost can be direct or indirect.

Q45: Cost behavior is considered curvilinear whenever a

Q88: Pedregon Corporation has provided the following information:<br>

Q91: Varela Corporation's relevant range of activity is

Q92: The University Store, Inc. is the major

Q94: Dominik Corporation purchased a machine 5 years

Q169: Selling and administrative expenses are period costs

Q226: A fixed cost is not constant per

Q276: Within the relevant range, variable costs can

Q277: Which costs will change with a decrease