Multiple Choice

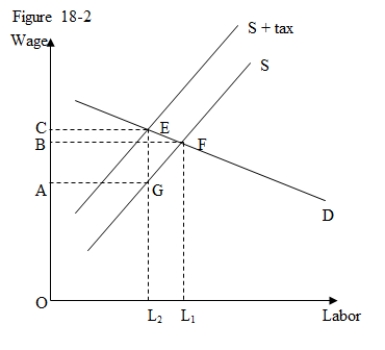

The figure given below shows the demand and supply curves of labor.A per-unit tax imposed on the wage income of the employees shifts the supply curve of labor upward.

-In Figure 18-2,as a result of a per-unit tax:

A) the total wage paid by employers rises,while the net-wage received by employees declines.

B) the total wage paid by employers declines,while the net-wage received by the employees rises.

C) the total wage paid by employers declines.

D) the total wage received by employees decline.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: The National Collegiate Athletic Association [NCAA] has

Q11: Minimum wage laws are promoted as the

Q16: A cartel agreement between input buyers would

Q21: The figure given below shows the impact

Q25: The figure given below shows the demand

Q26: The figure given below shows the demand

Q35: Which of the following best describes wage

Q53: The U.S.Social Security system:<br>A)invests the taxes paid

Q74: If the current Social Security system in

Q82: Which of the following categories of workers