Essay

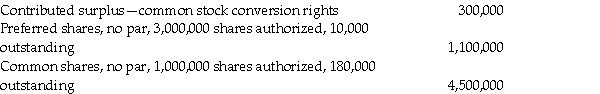

LMN Company reported the following amounts on its balance sheet at July 31,2018:

Liabilities

Convertible bonds payable,$10,000,000 face value 9%,due July 31,2019 9,909,091

Equity

Additional information

1.The bonds pay interest each July 31.Each $1,000 bond is convertible into 10 common shares.The bonds were originally issued to yield 10%.On July 31,2019,all the bonds were converted after the final interest payment was made.LMN uses the book value method to record bond conversions as recommended under IFRS.

2.No other share or bond transactions occurred during the year.

Required:

a.Prepare the journal entry to record the bond interest payment on July 31,2019.

b.Calculate the total number of common shares outstanding after the bonds' conversion on July 31,2019.

c.Prepare the journal entry to record the bond conversion.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Naples Corporation issued call options on 20,000

Q36: A company issues convertible bonds with face

Q46: A company had a debt-to-equity ratio of

Q47: AnnuG Inc.granted 200,000 stock options to its

Q49: On January 1,2015,Gilmore Inc.granted stock options to

Q50: In the table below,choose the financial instrument

Q51: Nappy Lodge issued 15,000 at-the-money stock options

Q52: Which is a derivative on the company's

Q56: Price Farms granted 290,000 stock options to

Q87: Roman Corporation issued call options on 5,000