Essay

LMN Company reported the following amounts on its balance sheet at July 31,2019:

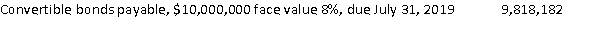

Liabilities

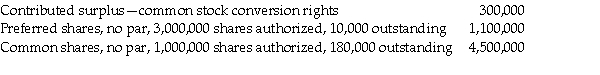

Equity

Additional information

1.The bonds pay interest each July 31.Each $1,000 bond is convertible into 5 common shares.The bonds were originally issued to yield 10%.On July 31,2019,all the bonds were converted after the final interest payment was made.LMN uses the book value method to record bond conversions as recommended under IFRS.

2.No other share or bond transactions occurred during the year.

Required:

a.Prepare the journal entry to record the bond interest payment on July 31,2019.

b.Calculate the total number of common shares outstanding after the bonds' conversion on July 31,2019.

c.Prepare the journal entry to record the bond conversion.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Which of the following is an example

Q10: Explain how convertible bonds alleviate moral hazard.

Q11: Give 4 examples of cash flow hedges:

Q12: What is an option?<br>A)A contract that gives

Q18: A company had a debt-to-equity ratio of

Q18: Which statement is correct about the accounting

Q21: On August 15,2018,Madison Company issued 10,000 options

Q43: Amel Company issues convertible bonds with face

Q70: How is the subsequent conversion of bonds

Q90: What is hedging?