Essay

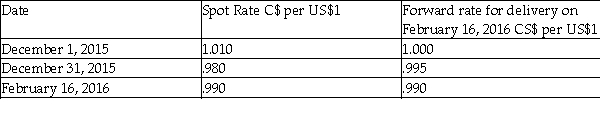

On December 1,2015,Mackenzie Mann Ltd.entered into a binding agreement to buy inventory costing US$300,000 for delivery on February 16,2016.Terms of the sale were COD (cash on delivery).Mackenzie Mann,which has a December 31 year-end,decided to hedge its foreign exchange risk and entered into a forward agreement to receive US$300,000 at that time.Mackenzie Mann designated the forward a fair value hedge.Pertinent exchange rates follow:

Required:

Record the required journal entries for December 1,December 31,and February 16 using the net method.If no entries are required,state "no entry required" and indicate why.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Contrast options with warrants.

Q24: Assume that Signh agrees to purchase US$100,000

Q34: On December 15, a company enters into

Q42: Which statement best describes the "zero common

Q75: McMillan Manufacturing issued 60,000 stock options to

Q77: Windy Lake Lodge issued 24,000 at-the-money stock

Q80: On January 1,2015,Braeben Inc.granted stock options to

Q97: A company issued 105,000 preferred shares and

Q102: A company issued 105,000 preferred shares and

Q109: Assume that Aero agrees to purchase US$50,000