Multiple Choice

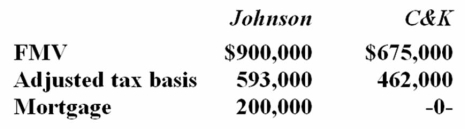

Johnson Inc. and C&K Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property. Compute C&K's gain recognized on the exchange and its tax basis in the property received from Johnson.

Pursuant to the exchange, C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property. Compute C&K's gain recognized on the exchange and its tax basis in the property received from Johnson.

A) $200,000 gain recognized; $662,000 basis in Johnson property

B) No gain recognized; $462,000 basis in Johnson property

C) No gain recognized; $487,000 basis in Johnson property

D) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Mrs. Cooley exchanged 400 shares of stock

Q33: Acme Inc.and Beamer Company exchanged like-kind production

Q46: Loonis Inc.and Rhea Company formed LooNR Inc.by

Q48: Doppia Company transferred an old asset with

Q60: Which of the following statements about the

Q60: IPM Inc. and Zeta Company formed IPeta

Q71: Babex Inc. and OMG Company entered into

Q77: Which of the following statements about nontaxable

Q93: Tarletto Inc.'s current year income statement includes

Q104: Which of the following statements about like-kind