Multiple Choice

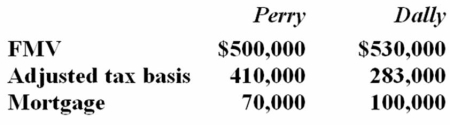

Perry Inc. and Dally Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, Perry assumed the mortgage on the Dally property, and Dally assumed the mortgage on the Perry property. Compute Perry's gain recognized on the exchange and its tax basis in the property received from Dally.

Pursuant to the exchange, Perry assumed the mortgage on the Dally property, and Dally assumed the mortgage on the Perry property. Compute Perry's gain recognized on the exchange and its tax basis in the property received from Dally.

A) No gain recognized; $410,000 basis in the Dally property

B) No gain recognized; $440,000 basis in the Dally property

C) $100,000 gain recognized; $410,000 basis in the Dally property

D) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Loonis Inc. and Rhea Company formed LooNR

Q11: Loonis Inc.and Rhea Company formed LooNR Inc.by

Q20: Muro Inc. exchanged an old inventory item

Q31: Mr Jamail transferred business personalty (FMV $187,000;

Q52: Mr Jamail transferred business personalty (FMV $187,000;

Q56: Thieves stole computer equipment used by Ms.James

Q72: Nixon Inc. transferred Asset A to an

Q80: Mrs. Volter exchanged residential real estate for

Q88: A taxpayer who realizes a loss on

Q96: Mr. Weller and the Olson Partnership entered