Multiple Choice

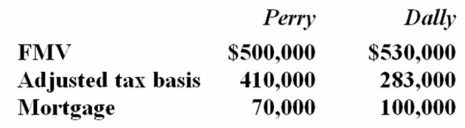

Perry Inc. and Dally Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, Perry assumed the mortgage on the Dally property, and Dally assumed the mortgage on the Perry property. Compute Dally's gain recognized on the exchange and its tax basis in the property received from Perry.

Pursuant to the exchange, Perry assumed the mortgage on the Dally property, and Dally assumed the mortgage on the Perry property. Compute Dally's gain recognized on the exchange and its tax basis in the property received from Perry.

A) $30,000 gain recognized; $313,000 basis in the Perry property

B) 100,000 gain recognized; $383,000 basis in the Perry property

C) $30,000 gain recognized; $283,000 basis in the Perry property

D) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q1: YCM Inc.exchanged business equipment (initial cost $114,800;

Q12: Gain realized on a property exchange that

Q22: Mr. Bentley exchanged investment land subject to

Q38: V&P Company exchanged unencumbered investment land for

Q48: Eight years ago,Prescott Inc.realized a $16,200 gain

Q52: A partnership always takes a carryover basis

Q65: A corporation's tax basis in property received

Q73: IPM Inc.and Zeta Company formed IPeta Inc.by

Q98: Sissoon Inc. exchanged a business asset for

Q101: Nagin Inc.transferred an old asset in exchange