Multiple Choice

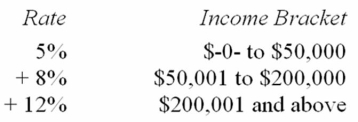

Jurisdiction M imposes an individual income tax based on the following schedule.  Which of the following statements is true?

Which of the following statements is true?

A) The schedule provides no information as to whether Jurisdiction M's tax is horizontally equitable.

B) Jurisdiction M's tax is vertically equitable.

C) Jurisdiction M's tax is vertically equitable only for individuals with $50,000 or less taxable income.

D) Both A. and B. are true.

Correct Answer:

Verified

Correct Answer:

Verified

Q22: Congress plans to amend the federal income

Q24: The federal income tax law allows individuals

Q35: Which of the following statements about the

Q38: Jurisdiction M imposes an individual income tax

Q42: Vervet County levies a real property tax

Q44: A progressive rate structure and a proportionate

Q47: According to supply-side economic theory, a decrease

Q48: Which of the following statements does not

Q77: Which of the following describes a tax

Q80: Which of the following statements concerning a