Multiple Choice

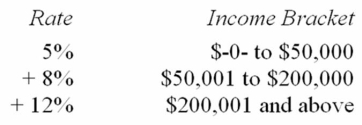

Jurisdiction M imposes an individual income tax based on the following schedule.  Which type of rate structure does this tax use?

Which type of rate structure does this tax use?

A) Proportionate

B) Regressive

C) Progressive

D) Multi-bracket

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q13: Jurisdiction P recently increased its income tax

Q27: The declining marginal utility of income across

Q35: Supply-side economic theory holds that people who

Q37: Which of the following tax policies would

Q43: Tax systems with regressive rate structures result

Q64: Changes in the tax law intended to

Q68: The statement that "an old tax is

Q73: A tax meets the standard of sufficiency

Q74: Vertical equity focuses on measurement of the

Q79: State use taxes are more convenient for