Multiple Choice

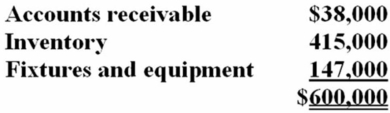

Mr. and Mrs. Schulte paid a $750,000 lump-sum price to purchase a business. At date of purchase, the appraised FMVs of the balance sheet assets were:  Which of the following statements is true?

Which of the following statements is true?

A) The Schultes must allocated the $750,000 cost to the balance sheet assets based on the assets' relative FMV.

B) The Schultes must capitalize $150,000 of the cost to nonamortizable goodwill.

C) The Schultes may deduct $150,000 of the cost as business goodwill.

D) None of the above is true.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Repair costs incurred to keep a tangible

Q18: Colby Company performed professional services for M&E

Q45: Which of the following statements about MACRS

Q53: The expense of adapting an existing asset

Q74: NRW Company, a calendar year taxpayer, purchased

Q75: NLT Inc. purchased only one item of

Q80: Broadus., a calendar year taxpayer, purchased a

Q84: Puloso Company, a calendar year taxpayer, incurred

Q95: Which of the following statements about tax

Q113: Cobly Company, a calendar year taxpayer, made