Multiple Choice

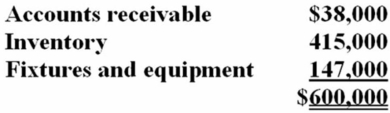

On April 2, Reid Inc., a calendar year taxpayer, paid a $750,000 lump-sum price to purchase a business. The appraised FMVs of the balance sheet assets were:  Which of the following statements is false?

Which of the following statements is false?

A) Reid must capitalize $150,000 of the cost as purchased goodwill.

B) Reid may amortize the $150,000 cost for both book and tax purposes.

C) Reid's amortization deduction for the current year is $7,500.

D) None of the above is false.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: A corporation that incurs $28,500 organization costs

Q24: Kassim Company purchased an asset by paying

Q28: Which of the following statements about amortization

Q50: Terrance Inc., a calendar year taxpayer, purchased

Q58: Song Company, a calendar year taxpayer, purchased

Q63: Kaskar Company,a calendar year taxpayer,paid $3,350,000 for

Q78: A firm can use LIFO for computing

Q87: This year, Zulou Industries capitalized $552,000 indirect

Q106: KJD Inc., a calendar year corporation, purchased

Q111: Merkon Inc. must choose between purchasing a