Essay

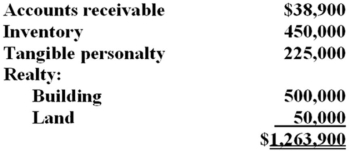

On May 1, Sessi Inc., a calendar year corporation, purchased a business for a $2 million lump-sum price. The business' balance sheet assets had the following appraised FMV.  a. Compute the cost basis of the goodwill acquired by Sessi Inc. on the purchase of this business.

a. Compute the cost basis of the goodwill acquired by Sessi Inc. on the purchase of this business.

b. Compute Sessi's goodwill amortization deduction for the year of purchase.

c. Use a 35 percent tax rate to compute Sessi's deferred tax liability resulting from the amortization deduction.

Correct Answer:

Verified

a. Sessi's cost basis in purchased goodw...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: Molton Inc. made a $60,000 cash expenditure

Q18: Elcox Inc. spent $2.3 million on a

Q36: Which of the following capitalized cost is

Q65: Dorian,a calendar year corporation,purchased $1,568,000 of equipment

Q74: Hoopin Oil Inc.was allowed to deduct $5.3

Q85: This year, Nigle Inc.'s auditors required the

Q100: Creighton, a calendar year corporation, reported $5,571,000

Q104: Kemp Inc., a calendar year taxpayer, generated

Q107: Gowda Inc.,a calendar year taxpayer,purchased $1,496,000 of

Q110: D&R Company,a calendar year corporation,purchased $1,116,000 of