Multiple Choice

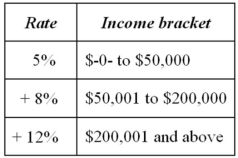

Jurisdiction M imposes an individual income tax based on the following schedule.  Which of the following statements is true?

Which of the following statements is true?

A) The schedule provides no information as to whether Jurisdiction M's tax is horizontally equitable.

B) Jurisdiction M's tax is vertically equitable.

C) Jurisdiction M's tax is vertically equitable only for individuals with $50,000 or less taxable income.

D) Both A.and B.are true.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Jurisdiction F levies a 10% excise tax

Q16: Government officials of Country Z estimate that

Q17: Jurisdiction M imposes an individual income tax

Q40: Which of the following statements about horizontal

Q42: Which of the following statements concerning income

Q55: The city of Hartwell spends about $3

Q73: A tax meets the standard of sufficiency

Q74: Vertical equity focuses on measurement of the

Q75: Which of the following statements concerning tax

Q78: A good tax should result in either