Multiple Choice

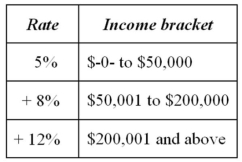

Jurisdiction M imposes an individual income tax based on the following schedule.  Ms. Owen has $314,000 taxable income. Compute the tax on this income.

Ms. Owen has $314,000 taxable income. Compute the tax on this income.

A) $29,680

B) $28,180

C) $37,680

D) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: The city of Berne recently enacted a

Q2: If a tax has a progressive rate

Q24: The federal income tax law allows individuals

Q35: Supply-side economic theory holds that people who

Q39: Congress recently amended the tax law to

Q44: A progressive rate structure and a proportionate

Q48: Which of the following statements does not

Q62: Which of the following statements about vertical

Q64: Changes in the tax law intended to

Q81: Congress originally enacted the federal estate and