Multiple Choice

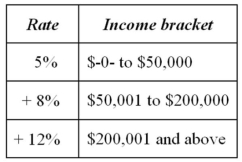

Jurisdiction M imposes an individual income tax based on the following schedule.  Which of the following statements is true?

Which of the following statements is true?

A) If Mrs.Hall's taxable income is $227,000, her average tax rate is 12%.

B) If Mr.Poe's taxable income is $41,200, his marginal tax rate is 8%.

C) If Ms.Kaye's taxable income is $63,800, her marginal tax rate is 8%.

D) None of the above is true.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: The federal government is not required to

Q17: The government of Nation C operated at

Q18: Which of the following statements about the

Q31: The state of California plans to amend

Q31: The city of Belleview operated at an

Q38: Vervet County levies a real property tax

Q39: Jurisdiction M imposes an individual income tax

Q48: Which of the following statements about the

Q59: Government officials of Country Z estimate that

Q80: Which of the following statements concerning a