Multiple Choice

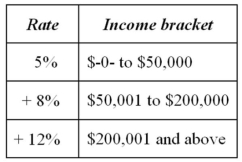

Jurisdiction M imposes an individual income tax based on the following schedule.  Which of the following statements is false?

Which of the following statements is false?

A) If Ms.Lui's taxable income is $33,400, her average tax rate is 5%.

B) If Mr.Bell's taxable income is $519,900, his marginal tax rate is 12%.

C) If Ms.Vern's taxable income is $188,000, her average tax rate is 7.2%.

D) None of the above is false.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: A dynamic forecast of the revenue effect

Q6: The sales tax laws of many states

Q23: Which of the following statements regarding a

Q30: Last year, Government G levied a 35%

Q37: Which of the following tax policies would

Q41: A provision in the tax law designed

Q63: The U.S. individual income tax has always

Q64: Congress plans to amend the federal individual

Q71: A convenient tax has low compliance costs

Q75: The City of Willford levies a flat