Multiple Choice

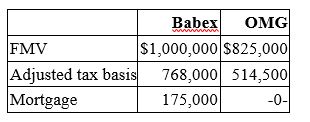

Babex Inc. and OMG Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, OMG assumed the mortgage on the Babex property. Compute Babex's gain recognized on the exchange and its tax basis in the property received from OMG.

Pursuant to the exchange, OMG assumed the mortgage on the Babex property. Compute Babex's gain recognized on the exchange and its tax basis in the property received from OMG.

A) $175,000 gain recognized; $768,000 basis in OMG property

B) No gain recognized; $768,000 basis in OMG property

C) $175,000 gain recognized; $943,000 basis in OMG property

D) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: Five years ago, Q&J Inc. transferred land

Q23: Mr. Jamail transferred business personality (FMV $187,000;

Q30: Berly Company transferred an old asset with

Q46: Tibco Inc. exchanged an equity interest in

Q54: Gem Company's manufacturing facility was destroyed by

Q63: Mr. Slake sold 1,580 shares of publicly

Q73: IPM Inc.and Zeta Company formed IPeta Inc.by

Q77: Which of the following statements about nontaxable

Q94: Kimbo Inc. exchanged an old asset ($180,000

Q99: Mrs.Brinkley transferred business property (FMV $340,200; adjusted