Multiple Choice

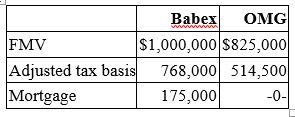

Babex Inc. and OMG Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, OMG assumed the mortgage on the Babex property. Compute OMG's gain recognized on the exchange and its tax basis in the property received from Babex.

Pursuant to the exchange, OMG assumed the mortgage on the Babex property. Compute OMG's gain recognized on the exchange and its tax basis in the property received from Babex.

A) $175,000 gain recognized; $514,500 basis in Babex property

B) No gain recognized; $689,500 basis in Babex property

C) No gain recognized; $514,500 basis in Babex property

D) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: The tax basis in property received in

Q7: Vincent Company transferred business realty (FMV $2.3

Q22: Mr. Bentley exchanged investment land subject to

Q25: If a taxpayer elected to defer a

Q31: Three individuals transferred property to newly formed

Q52: Johnson Inc. and C&K Company entered into

Q53: Johnson Inc. and C&K Company entered into

Q54: Kornek Inc. transferred an old asset with

Q72: Nixon Inc. transferred Asset A to an

Q86: Nontaxable exchanges typically cause a temporary difference