Multiple Choice

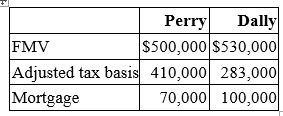

Perry Inc. and Dally Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, Perry assumed the mortgage on the Dally property, and Dally assumed the mortgage on the Perry property. Compute Dally's gain recognized on the exchange and its tax basis in the property received from Perry.

Pursuant to the exchange, Perry assumed the mortgage on the Dally property, and Dally assumed the mortgage on the Perry property. Compute Dally's gain recognized on the exchange and its tax basis in the property received from Perry.

A) $30,000 gain recognized; $313,000 basis in the Perry property

B) 100,000 gain recognized; $383,000 basis in the Perry property

C) $30,000 gain recognized; $283,000 basis in the Perry property

D) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: A taxpayer who pays boot in a

Q16: Five years ago, Q&J Inc. transferred land

Q23: Mrs. Brinkley transferred business property (FMV $340,200;

Q30: Berly Company transferred an old asset with

Q34: Doppia Company transferred an old asset with

Q65: A corporation's tax basis in property received

Q66: A fire destroyed furniture and fixtures used

Q77: Which of the following statements about nontaxable

Q79: Which of the following statements about the

Q100: Hank exchanged an old asset with a