Multiple Choice

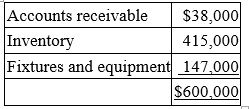

On April 2, Reid Inc., a calendar year taxpayer, paid a $750,000 lump-sum price to purchase a business. The appraised FMVs of the balance sheet assets were:  Which of the following statements is false?

Which of the following statements is false?

A) Reid must capitalize $150,000 of the cost as purchased goodwill.

B) Reid may amortize the $150,000 cost for both book and tax purposes.

C) Reid's amortization deduction for the current year is $7,500.

D) None of the above is false.

Correct Answer:

Verified

Correct Answer:

Verified

Q15: An asset's adjusted book basis and adjusted

Q44: In 2014, Rydin Company purchased one asset

Q45: Song Company, a calendar year taxpayer, purchased

Q61: The after-tax cost of an expenditure is

Q77: Zola Inc. paid a $10,000 legal fee

Q89: Poole Company made a $100,000 cash expenditure

Q95: Which of the following statements about tax

Q96: Shelley purchased a residential apartment for $1,400,000

Q106: KJD Inc., a calendar year corporation, purchased

Q113: Cobly Company, a calendar year taxpayer, made