Essay

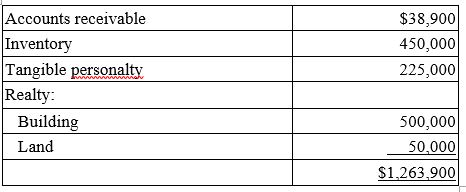

On May 1, Sessi Inc., a calendar year corporation, purchased a business for a $2 million lump-sum price. The business' balance sheet assets had the following appraised FMV.

Correct Answer:

Verified

a. Compute the cost basis of the goodwil...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: Follen Company is a calendar year taxpayer.On

Q27: Hextone Inc.,which has a 35% tax rate,purchased

Q45: Which of the following statements about MACRS

Q46: Kigin Company spent $240,000 to clean up

Q63: Kaskar Company,a calendar year taxpayer,paid $3,350,000 for

Q87: This year, Zulou Industries capitalized $552,000 indirect

Q91: Laven Company, a calendar year taxpayer, purchased

Q92: Lensa Inc. purchased machinery several years ago

Q98: NRW Company, a calendar year taxpayer, purchased

Q110: D&R Company,a calendar year corporation,purchased $1,116,000 of