Multiple Choice

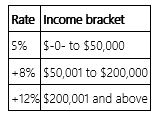

Jurisdiction M imposes an individual income tax based on the following schedule.  Which of the following statements is true?

Which of the following statements is true?

A) If Mrs. Hall's taxable income is $227,000, her average tax rate is 12%.

B) If Mr. Poe's taxable income is $41,200, his marginal tax rate is 8%.

C) If Ms. Kaye's taxable income is $63,800, her marginal tax rate is 8%.

D) None of the above is true.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Which of the following statements about a

Q34: Which of the following statements does not

Q38: Jurisdiction M imposes an individual income tax

Q41: Jurisdiction M imposes an individual income tax

Q62: Which of the following statements about vertical

Q63: The U.S. individual income tax has always

Q72: Which of the following statements concerning the

Q75: The City of Willford levies a flat

Q79: State use taxes are more convenient for

Q81: Many taxpayers believe the income tax system