Multiple Choice

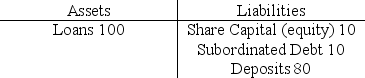

The following questions apply to the following simplified bank balance sheet

-Shareholders in the bank above are offered the following deal.The bank will gamble the whole loan book on a double or nothing coin toss (i.e.50% chance loan book doubles in value,50% chance it has zero value) .From the shareholders point of view,this deal

A) gives them a 50% chance of losing 10 and a 50% chance of gaining 10

B) gives them a 50% chance of losing 10 and a 50% chance of gaining 20

C) gives them a 50% chance of losing 10 and a 50% chance of gaining 100

D) gives them a 50% chance of losing 100 and a 50% chance of gaining 100

E) gives them a 50% chance of losing 100 and a 50% chance of gaining 200

Correct Answer:

Verified

Correct Answer:

Verified

Q1: The bank lending channel of a credit

Q2: Recessions involving a credit crunch tend to

Q3: A company wishes to borrow $10,000 but

Q4: Given the payoff matrix for a Bank

Q5: The broad credit channel of a credit

Q7: A bus breaks down outside a small

Q8: Shareholders in a bank may encourage excessive

Q9: Generally speaking,bank deposits<br>A) are a larger share

Q10: The key argument for a government-backed deposit

Q11: A key difference between a Commercial and