Multiple Choice

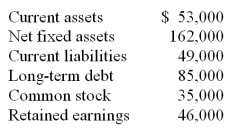

A firm has the following account balances for this year. Sales for the year are $600,000. Projected sales for next year are $642,000. The percentage of sales approach is used for pro forma purposes. All balance sheet accounts, except long-term debt and common stock, change according to that approach. The firm plans to decrease the long-term debt balance by $5,000 next year. Retained earnings is expected to increase by $3,500 next year. What is the projected external financing need?

A) $10,520

B) $13,120

C) $18,520

D) $20,720

E) $25,620

Correct Answer:

Verified

Correct Answer:

Verified

Q6: What is the financing cash flow, given

Q8: What is the operating cash flow, given

Q9: Why is the expected rate of sales

Q14: A firm has net income of $20,000

Q15: What is the operating cash flow, given

Q16: Glassmakers, Inc. purchased $125,500 of new equipment

Q30: Net income is equal to which one

Q62: Last year,a firm had net income of

Q79: Explain the role the external financing need

Q79: A firm has a price-cash flow ratio