Multiple Choice

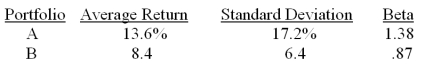

What is the Treynor ratio of a portfolio comprised of 50 percent portfolio A and 50 percent portfolio B?  The risk-free rate is 3.12 percent and the market risk premium is 8.5 percent.

The risk-free rate is 3.12 percent and the market risk premium is 8.5 percent.

A) .041

B) .058

C) .070

D) .114

E) .136

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q3: A portfolio has a beta of 1.23

Q13: Which one of the following measures returns

Q14: The U.S.Treasury bill is yielding 1.85 percent

Q50: A fund has an alpha of 0.73

Q51: Angie owns a portfolio which has an

Q53: A portfolio consists of the following two

Q59: Your portfolio has a beta of 1.24,

Q78: The Sharpe ratio is best used to

Q83: Which of the following measures are dependent

Q89: A portfolio has an expected annual return