Multiple Choice

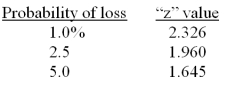

You have a portfolio which has an average return of 12.6 percent. In any given year, you have a 2.5 percent probability of earning either a zero or a negative annual return. What is the approximate standard deviation of your portfolio?

A) 5.44 percent

B) 6.43 percent

C) 6.94 percent

D) 7.60 percent

E) 8.14 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q1: A portfolio has a 2.5 percent chance

Q4: Mike's portfolio has a two-year expected return

Q12: Your portfolio has an expected annual return

Q21: A diversified portfolio has a beta of

Q24: A portfolio consists of the following two

Q25: A portfolio has a beta of 1.52

Q26: Which one of the following correctly

Q27: A portfolio has an average return of

Q28: The U.S. Treasury bill is yielding 3.0

Q32: A portfolio has an actual return of